Kya aap apne PAN card ko apne Aadhaar card se kaise jodne ka ek kadam-kadam tarika khoj rahe hain? Apne PAN card ko apne Aadhaar card se jodna, aapke arthik sandarbh ko surakshit aur track kiya jata hai. Is lekh mein, hum aapko kuch asan kadam bataenge jisse aap apna PAN card apne Aadhaar card se jod sakte hain. Hum yahan apne PAN card ko Aadhaar card se jodne ke fayde aur is prakriya ko pura karne ke liye aavashyak dastavejo ke bare mein bhi baat karenge. To chaliye shuru karte hain!

Apne PAN Card ko Aadhaar Card se Jodne ki Jarurat Kya hai?

Permanent Account Number (PAN) 10 anko ka ek vishisht alphaneumerik pahachan hai jo Bharat ke Income Tax Vibhag dvara kar bharna wale vyakti ya sansthao ko diya jata hai. Iska upyog sabhi arthik gatividhiyon ko track karne aur sahi matra mein kar bharna ke liye kiya jata hai.

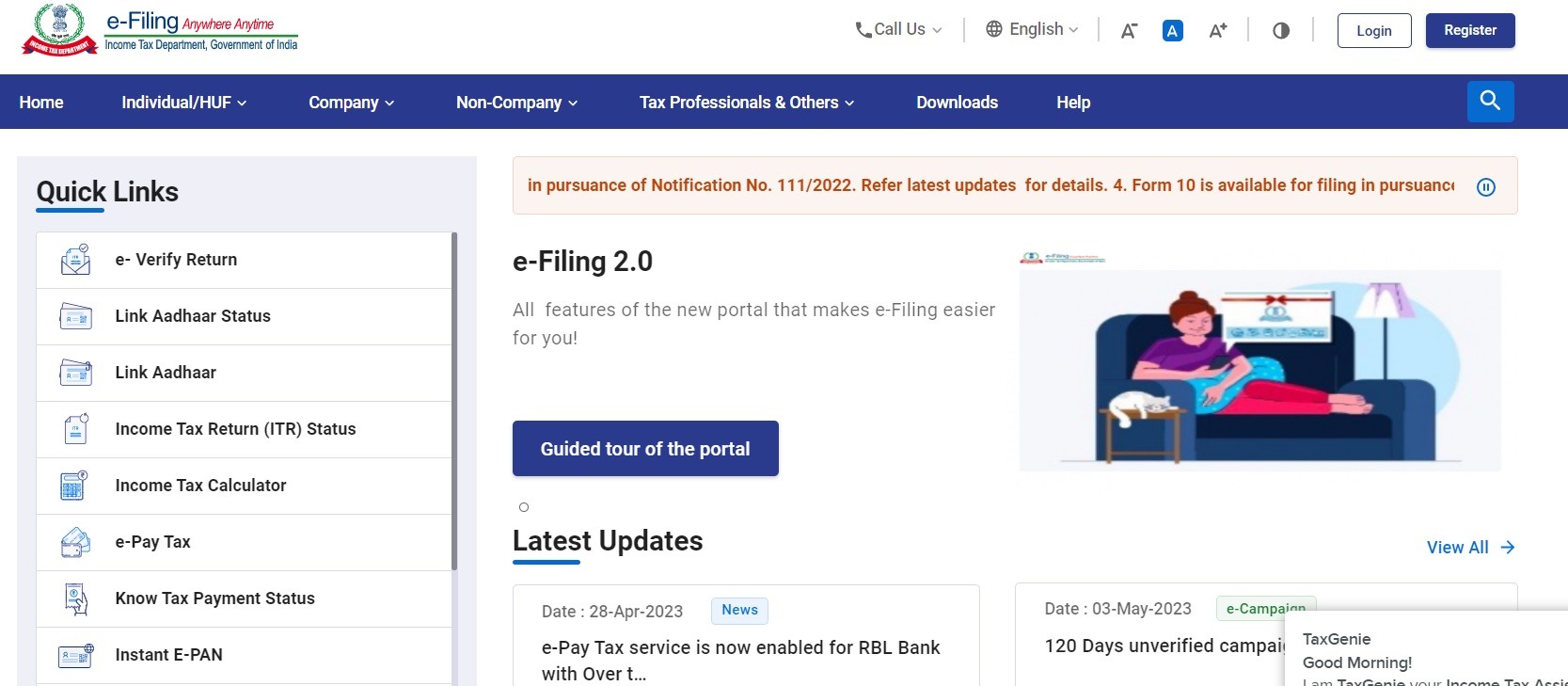

Income tax Website to Link Aadhar and Pan

Aadhaar Card Bharat ke sabhi nagarikon ko diya jane vala ek vishisht 12-ank ka pahachan hai. Yeh jati, janm tithi, pata, tasveer aur ungaliyon ke nishan jaise jan-jatiya aur bio-metrik jankariyon ka sangrah karti hai.

Bharat Sarkar ne apne PAN Card ko Aadhaar Card se jodne ko avashyak kar diya hai. Isse yah hote hai ki sabhi kar dhatare sahi matra mein kar bharte hai aur tax bhag hone se bachte hain. Isse pahle ye bhi tax chor, chor-pakari aur pahchan ki chori ke aapatti ko rokne mein madad karta hai.

Apne PAN Card ko Aadhaar Card se jodne ka tarika saral aur sidha hai. Aapko kewal Income Tax Vibhag ke vebasait par log in karke apne PAN Card aur Aadhaar Card ki jankariyan darj karni hoti hai. Jaise hi aap jankariyan darj karenge, aapke paas aapke registerd mobile number par OTP (One Time Password) bheja jayega. Aapko OTP daalna hai aur ‘Link Now’ button par click karna hai. Aapka PAN Card aur Aadhaar Card turant joda jayega.

Apne PAN Card ko Aadhaar Card se jodna bahut avashyak hai, kyonki yah aapki sahi matra mein aur sahi samay par tax bharna mein madad karta hai. Isse aapko pahchan ki chori aur fraud se bachata hai. Iske alava, yah yah bhi surakshit karne mein madad karta hai ki sabhi kar dhatare sahi matra mein kar bharte hain aur sarkar sahi matra mein tax jama kar paati hai.

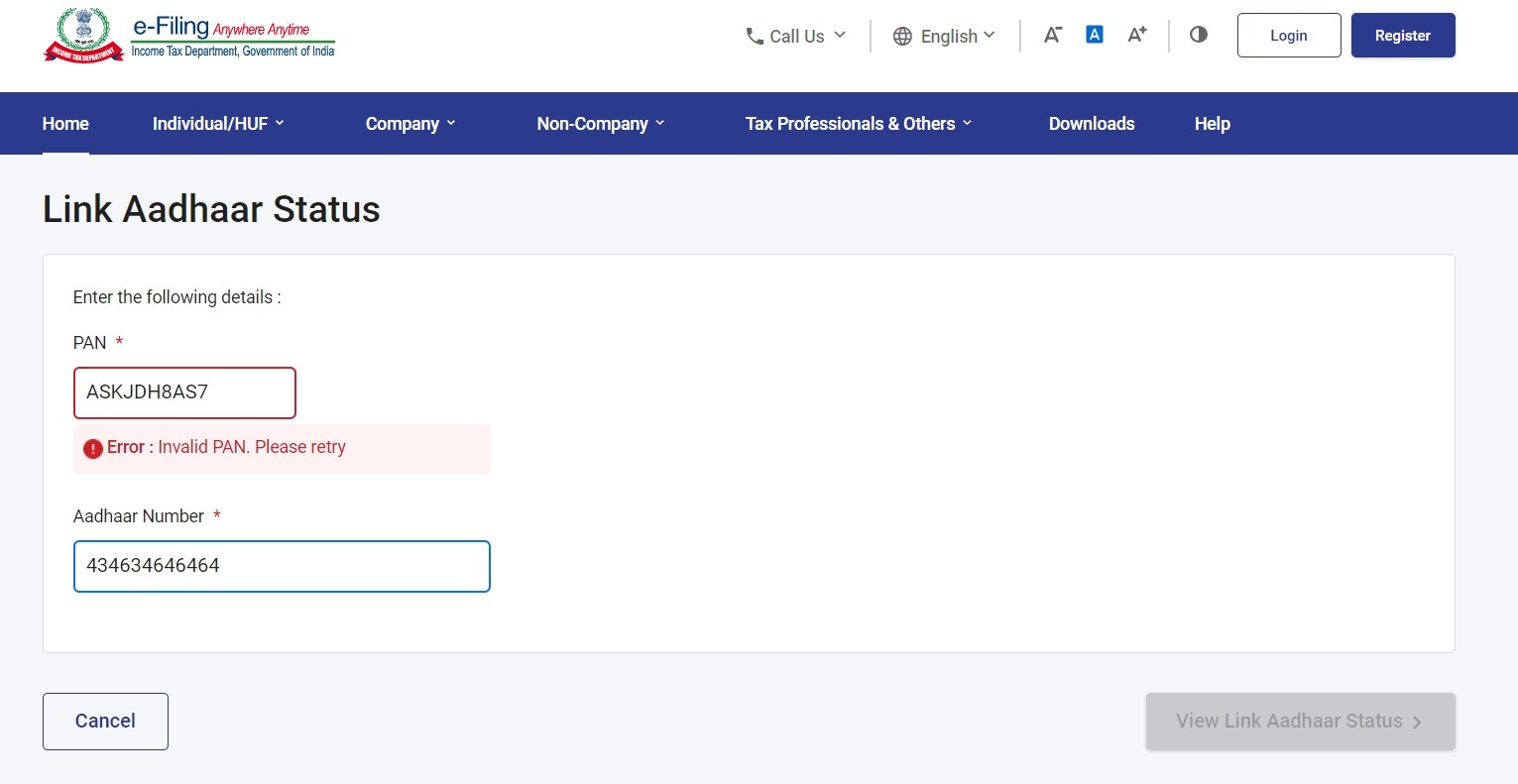

Aapka PAN Card Apne Aadhaar Card se Juda Hai Ya Nahi, Iska Kaise Pata Karein?

Ek Permanent Account Number (PAN) card Bharatiya Aaykar Vibhag dwara jaari ek mahatvapurna dastavej hai. Yah ek aisa anokha 10-digit alphanumeric number hai jo vibhinn vittiy udhyogon jaise income tax returns bharna, bank khata kholna, ya nivesh karne ke liye upayog kiya jata hai. Yah bhi vibhinn vittiy khataon jaise mutual funds, insurance policies aur bank accounts ko jodne ke liye bhi upayog kiya jata hai.

Bharat Sarkar ne aapke PAN card ko aapke Aadhaar card se jodne ke liye anivarya kar diya hai. Iska uddeshya hai ki sabhi vittiy gatividhiyon ka anupalakshan aur nigrani kiya ja sake. Isse fraud aur paisa dhone se bhi roka ja sakta hai.

Agar aapko yah nahi pata hai ki kya aapka PAN card aapke Aadhaar card se joda hua hai ya nahi, to aap kuchh kadam utha sakte hain.

Pahla kadam hai Aaykar Vibhag ke adhikarik website par jaana. Jab aap website par honge, tab aapko apne PAN card number aur janm tithi ka upayog karke login karna hoga. Login karne ke baad, aap apne PAN card ki jaankari dekh sakenge. Is pannon par, aapko aapke PAN-Aadhaar jodne ke status ko jaanne ka ek vikalp dikhaya jayega. Agar aapka PAN card pahle se hi aapke Aadhaar card se joda hua hai, to yah pannon par dikhaya jayega.

Yadi aap website par apane PAN-Aadhaar jodne ke status ko jaanne mein asamarth hain, to aap SMS facility ke madhyam se bhi isako jaan sakte hain. Iske liye, aapko 567678 ya 56161 par “UIDPAN” shabd ke saath ek SMS bhejna hoga. Fir aapko apane PAN-Aadhaar jodne ke status ka ek SMS prapt hoga.

Aap apane najdiki Aadhaar Enrolment Centre jaakar bhi apane PAN-Aadhaar jodne ke status ko jaan sakte hain. Kendra par pahunchne par, aapko apane Aadhaar card aur PAN card ki jaankari deni hogi. Kendra ke adhikari isake baad aapke PAN-Aadhaar jodne ke status ko jaan sakte hain.

Yah mahatvapurn hai ki aap apane PAN card ko apane Aadhaar card se jodna aavashyak hai kyonki yah sabhi vittiy gatividhiyon ke liye anivarya hai. Yadi aapko yah nahi pata hai ki kya aapka PAN card aapke Aadhaar card se pahle se hi joda hua hai ya nahi, to aap upar ullekh kiye gaye kadam ko follow kar sakte hain.

Step-by-Step Guide to Link Your PAN Card with Your Aadhaar Card Online

Apne PAN Card ko apne Aadhaar Card se online link karne ka ek saral tarika hai, jo sarkar ke nirdesho ke anusaar aapke vaarthon ko surakshit aur anumodit banaega. Iske liye aapko ek chhota sa online process karna hoga. Yahaan par hum aapko ek kadam se kadam ka tareeka bata rahe hain, jisse aap aasaani se apne PAN Card ko Aadhaar Card se link kar sakte hain:

Step 1: Bharat ke Income Tax Department ki official website par jaayen.

Step 2: Ghar ke praveshikaran par, ‘Link Aadhaar’ vikalp par click karen.

Step 3: Aapko ek naye pannon par bheja jaayega, jahaan aapko apna PAN Card aur Aadhaar Card ka number daalna hoga.

Step 4: Page par dikhaye gaye captcha code ko daalein aur ‘Link Aadhaar’ button par click karein.

Step 5: Aapke registered mobile number par ek OTP (One Time Password) aayega. OTP ko diye gaye box mein daalein aur ‘Validate’ button par click karein.

Step 6: Aapka PAN Card aur Aadhaar Card link ho jaayega.

Yaad rakhein ki aapko yeh dhyaan dena hoga ki daale gaye details sahi hon. Agar details mein koi gadbad hogi toh link karne ki prakriya safal nahi hogi. Iske saath hi, aapke mobile number ko aapke Aadhaar Card se joda hona bhi avashyak hai.

Jab aapka PAN Card aur Aadhaar Card link ho jaata hai, toh aap apne Aadhaar Card ka upyog apne income tax returns bharnge mein kar sakte hain. Aap bank account khole, mutual fund mein nivesh karein jaise anya vittiye sandarbh mein bhi aap apne Aadhaar Card ka upyog kar sakte hain.

Toh, yadi aapne abhi tak apne PAN Card ko Aadhaar Card se link nahi kiya hai, toh upar diye gaye kadam ko follow karke ise abhi link karein. Yeh kuch hi minute mein online kiya ja sakta hai aur bahut hi saral hai.

What to Do if Your PAN Card is Not Linked to Your Aadhaar Card?

Agar aapka PAN card aapke Aadhaar card se link nahi hai, to aapko iss situation ko sudhaarne ke liye kadam uthane ki zaroorat hai. Apne PAN card ko apne Aadhaar card se link karna, tax file karne, bank account kholne aur anya financial transactions ke liye zaroori hai. Bhagvan behtar hai ki, apne PAN card ko Aadhaar card se link karne ka process bahut hi simple aur seedha hai.

Pehle kadam yeh hai ki aap apne PAN card aur Aadhaar card ke naam same ho. Agar aapke PAN card ke naam aapke Aadhaar card ke naam se match nahi karte hain, toh aapko apne PAN card ki information update karne ki zaroorat hogi. Aap isse Income Tax Department of India ki website par jaakar aur required documents submit karke kar sakte hai.

Jab aapke PAN card aur Aadhaar card ka naam same ho jaaye, tab aap unhe link karne ka process shuru kar sakte hain. Aap ise online ya PAN card center par jaakar bhi kar sakte hain. Apne PAN card aur Aadhaar card ko link karne ke liye online jaana hai, toh aapko Income Tax Department of India ki website par jaana hai aur apna PAN card number, Aadhaar card number aur Aadhaar card mein jo naam hai woh enter karna hai. Jab aap saare required information enter kar denge, toh aapko “Link Aadhaar” button par click karna hoga.

Agar aap apne PAN card aur Aadhaar card ko personal level pe link karna chahte hain, toh aap ek PAN card center par ja sakte hain. Center par jaate hi, aapko apna PAN card aur Aadhaar card provide karna hoga aur ek form fill-out karna hoga. Form fill-out karne ke baad, aapko usse center mein submit karna hoga.

Jab aapka PAN card aur Aadhaar card link ho jaaye, toh aapko ek confirmation message receive hoga. Yeh message indicate karega ki aapke PAN card aur Aadhaar card ab link ho chuke hain. Is message ko apne records ke liye rakhna zaroori hai.

Apne PAN card aur Aadhaar card ko link karna, filing aur anya financial transactions ke liye bahut hi zaroori hai. Upar diye gaye steps follow karke, aap aasani se apne PAN card aur Aadhaar card ko link kar sakte hain.

Apne PAN card ko aadhaar card ke saath jodne ke fayde

Apne PAN card ko apne Aadhaar card se link karne ke fayde

Apne PAN card ko apne Aadhaar card se link karna ek bahut hi mahatvapurna kadam hai, kyunki isse aapke kee financial transactions surakshit hote hain aur sarkar ke niyamon ke anusaar ho jaate hain. Isse aapke paas kai laabh hote hain. Kuchh fayde nimn hain:

1. Income Tax Returns: PAN card aur Aadhaar card ko link karne ke baad aap aasaani se apne income tax returns file kar sakte hain.

2. Bank Accounts: PAN card aur Aadhaar card ko link karne ke baad aapko bank account khole mein aasaani hogi aur saath hi bank transactions mein bhi sahayata milegi.

3. Subsidies: PAN card aur Aadhaar card ko link karne se sarkari subidhaaon ka upayog karne mein aasaani hogi.

4. Mobile Connections: Agar aapke paas PAN card aur Aadhaar card link hai to aap aasaani se mobile connection le sakte hain.

5. Mutual Funds: PAN card aur Aadhaar card ko link karne ke baad aap aasaani se mutual funds mein nivesh kar sakte hain.

6. Insurance Policies: PAN card aur Aadhaar card ko link karne ke baad aap aasaani se insurance policies khareed sakte hain.

Isliye, apne PAN card aur Aadhaar card ko link karke in sabhi laabhon ka upayog karen.